TreasureCoast Covid 19 Update May 13 2020

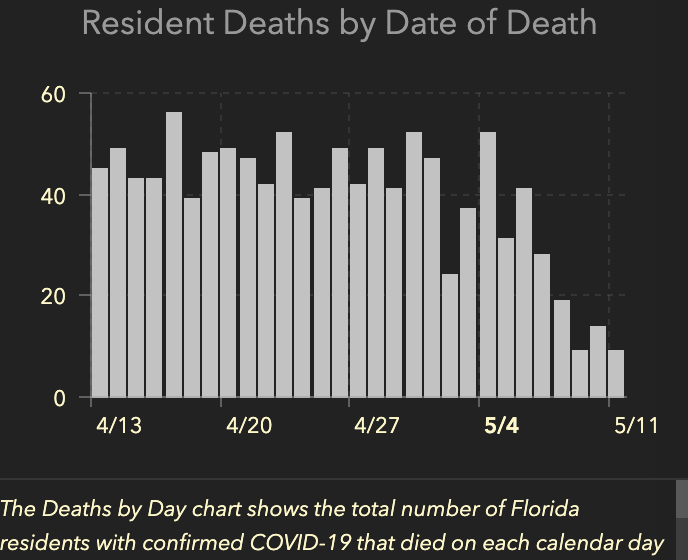

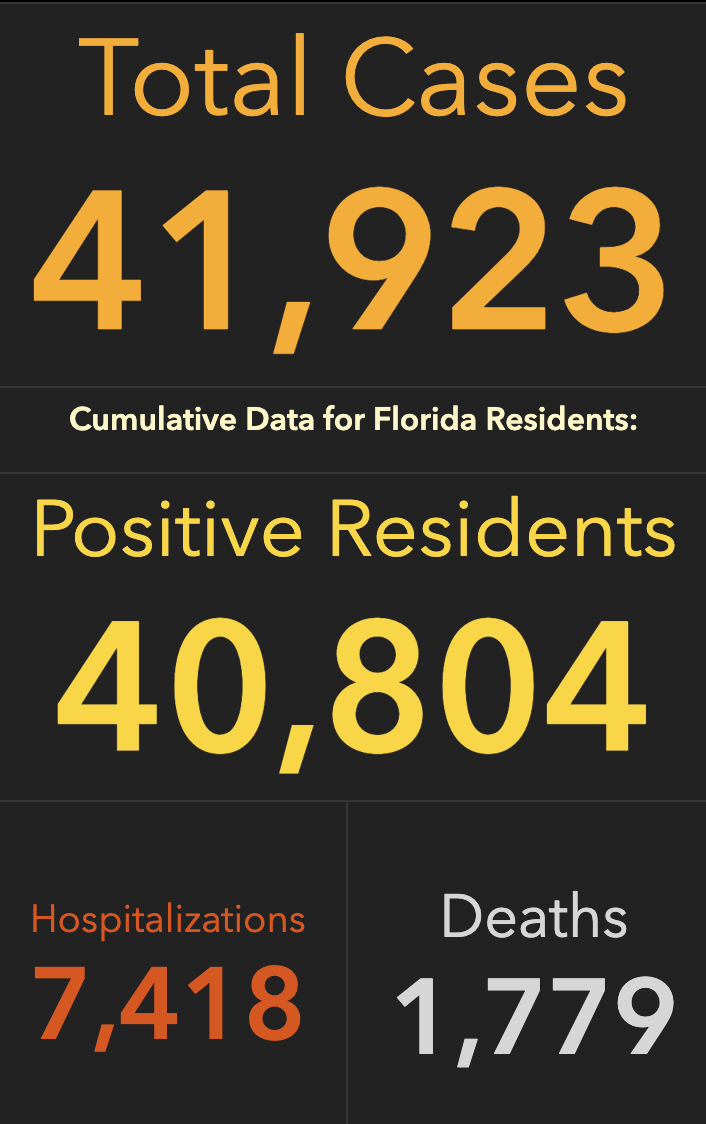

The number of coronavirus cases in Florida is approaching 42-thousand. The death toll has climbed to 17-hundred-79.

———

A former Florida governor is giving the current occupant of that office props for his handling of the state’s reopening. Charlie Crist, now a member of Congress, talking about Ron DeSantis.

Crist spoke at a coronavirus roundtable in Tampa.

————————

Universal Orlando will soon begin to reopen.

Officials announced yesterday that CityWalk will open today. The Universal Studios Store will be open, along with some restaurants and Hollywood Drive-In Golf, but the theme park, movie theater and nightclubs will remain closed. Face masks and temperature checks are required for visitors and employees.

—————————

Even with a global pandemic, Florida’s real estate industry is going strong.

TreasureCoast Covid 19 Update May 13 2020

————————————

According to the IRS, nearly 130 million Americans have received a government stimulus check in recent weeks. But if you’re among the millions still waiting on one, there might be a reason why.

For those awaiting a stimulus check, Americans can go to the “Get My Payment” page on the IRS website. Here, Americans can check the status of their payment.

Those who have not entered in direct deposit information with the IRS, and are not a recipient of government benefits, should expect a check in the mail from the IRS in the coming months.

Also, some taxpayers who used “refund anticipation loans” may have their return delayed as payments went to tax preparers instead of taxpayers. For many, the stimulus checks are being returned to the IRS, which in turn, the IRS will send a paper check to qualified taxpayers.

(1) You have not filed a 2019 tax return, or the IRS has not finished processing your 2019 return

Payments are automatic for eligible people who filed a tax return for 2018 or 2019.

(2) Claimed dependents are not eligible for an additional $500 payment

Only children eligible for the Child Tax Credit qualify for the additional payment of up to $500 per child. To claim the Child Tax Credit, the taxpayer generally must be related to the child, live with them more than half the year and provide at least half of their support.

(3) Dependents are college students

Pursuant to the CARES Act, dependent college students do not qualify for an EIP, and even though their parents may claim them as dependents, they normally do not qualify for the additional $500 payment. For example, under the law, a 20-year-old full-time college student claimed as a dependent on their mother’s 2019 federal income tax return is not eligible for a $1,200 Economic Impact Payment.

(4) Claimed dependents are parents or relatives, age 17 or older

If a dependent is 17 or older, they do not qualify the additional $500. If a taxpayer claimed a parent or any other relative age 17 or older on their tax return, that dependent will not receive a $1,200 payment.

(5) Past-due child support was deducted from the payment

The Economic Impact Payment is offset only by past-due child support. The Bureau of the Fiscal Service will send the taxpayer a notice if an offset occurs.

(6) Garnishments by creditors reduced the payment amount

Federal tax refunds, including the Economic Impact Payment, are not protected from garnishment by creditors by federal law once the proceeds are deposited into a taxpayer’s bank account.

(7) What if the amount of my Economic Impact Payment is incorrect?

Everyone should review the eligibility requirements for their family to make sure they meet the criteria.

In many instances, eligible taxpayers who received a smaller-than-expected Economic Impact Payment (EIP) may qualify to receive an additional amount early next year when they file their 2020 federal income tax return.

As a reminder, here is who is eligible for a stimulus check:

$2,400 – Couples earning less than $150,000 a year (couples earning $150,000 – $198,000 will receive a prorated check).

$1,200 – Individuals earning less than $75,000 a year (individuals earning $75,000 – $99,000 will receive a prorated check).

$1,200 – Heads of households earning less than $112,500 (heads of households earning $112,500 – $136,000 will receive a prorated check).

$500 – Each dependent child age 16 or under as of Dec. 31, 2019 (for qualifying individuals and couples).

———————

The Martin County School District has canceled all summer camps scheduled to be held on District property.

In addition, the District announced that all classes and academic programs – including Extended School Year (ESY) and credit recovery programs – will be held virtually during the summer months.

Third Grade Summer Reading Academy, First Grade Reading Camp, and enrichment programs for children of migrant workers will be offered virtually. For more information visit martinschools.org.

——————————————